Do You Know?

Important dates for GST Return

Latest News for GST

Intra-state Implementation of E-way bills for Telangana,Gujarat, Uttar Pradesh, Andhra Pradesh and Kerala starts from 15th April 2018. Notification by states will be issued.

Know More About GST

EXPRIENCE THE LIVE TOUR OF RELAX-G

Relax G

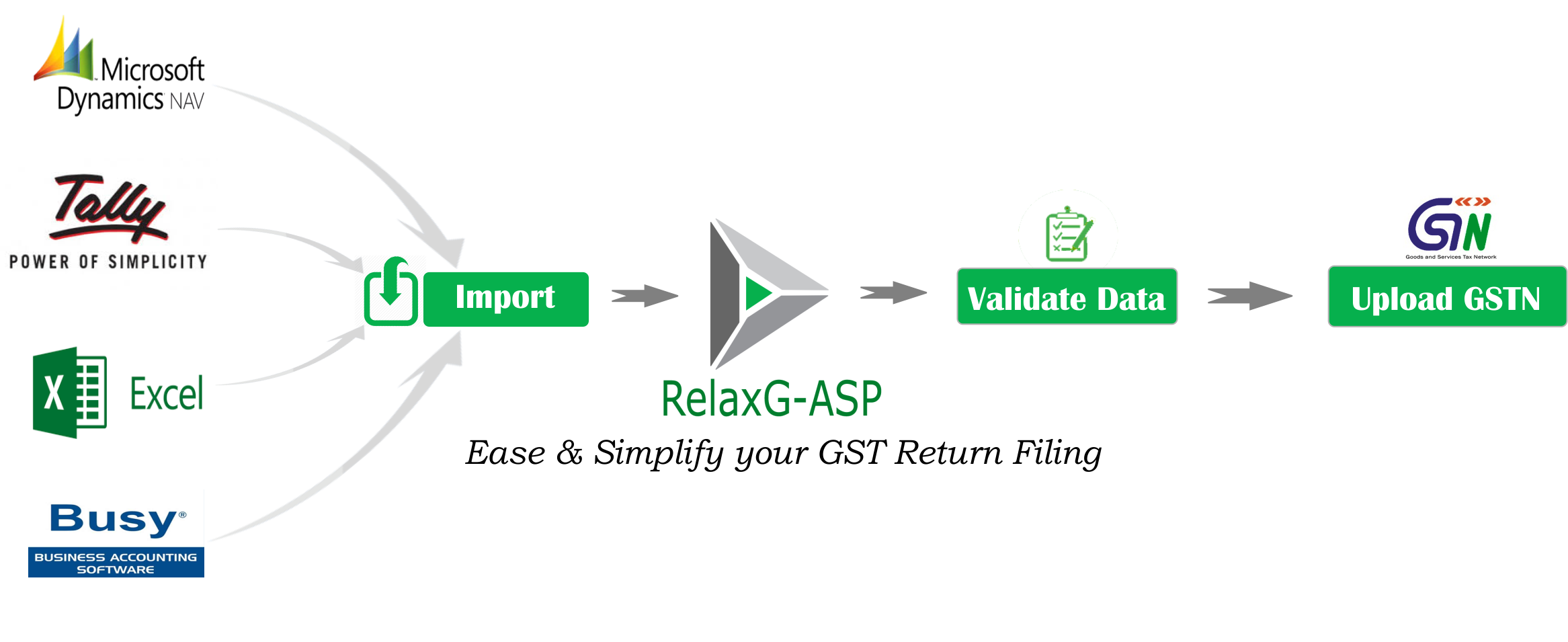

GST calculation is the most frustrating work to manage as it is multi-state Goods and Services Tax (GST) – and the very first place where something probably goes wrong. Being familiar to rates, exemptions, tax rules, and when you need to apply tax can be challenging as well as daunting, especially when you are dependent on people or basic accounting systems to do it for you. Keep calm, the automated tax calculation and compliance engine are highly accurate and time-saving. Our software Relax G upload data on the GSTN portal without any involvement of CSV or excel or JSON format. You not only reduce audit risk but also save time and money too. You can get error-free reports with full proof of data security. You can file your returns on time every time. Our Software has helped to our customers to file their return in just four easy steps. Relax G has many unique feature one of the features is that we don’t need to login on GSTN Portal for filing return. Relax-G is integrated with Tally, Microsoft Dynamics NAV, Busy and Excel. Relax-G can validate data, do reconciliation of mismatched invoices which is help to customer in filing their returns. This Solution Focused on improving financial performance of customer’s business

Integrated With

Clients

Projects

Support

Skilled Developers

Why Relax G

Save Money

Save yourself from paying huge amounts of unwanted taxes/over payment of taxes.

Speed Up

Inbuilt controlled processes to reduce probilty of potential security or audits and enhance the speed of operation of your accounting & compliance department.

GST File

File your GST Returns Accurately, ontime & everytime.

Data Security

Full Proof Data Security to prevent your confidentialfinancial data & information.

Analytical Dashboard

Analytical Dashboard summarizing compliance history and to plan pending action related to your GSTR Filing.

Error

Produce an exception report with error codes for user to take corrective action.

Accounting

Keep your accounting books in Sync with GSTR Filing done and to get the Input Tax Credit.

GSTR Reports

Reduce tremendous amount of transactions pressure to validate & correct GSTR Reports, mistakes & error.

Our Clients